10 interesting facts about the FHA

The Federal Housing Administration has been at the forefront of efforts to increase homeownership in the U.S., particularly for first-time homebuyers and those with limited resources. Beyond its role in helping millions of Americans purchase their homes, it has also left an indelible mark on housing policies, mortgage practices, and the pursuit of housing equity.

This article explores 10 interesting facts about FHA’s history and its ongoing commitment to promote home ownership in the U.S.

It was created during the Great Depression

In his second inaugural address, President Franklin Roosevelt said "I see one-third of a nation ill-housed, ill-clad, ill-nourished.” Roosevelt created the FHA in 1934 as part of the National Housing Act. Its purpose was to stimulate the housing market and make homeownership more accessible during a time of economic hardship.

It played a crucial role in suburbanization

After World War II, the FHA provided insurance for low-down-payment loans, making it easier for veterans and other Americans to purchase homes in newly developed suburbs. This contributed to the postwar suburban boom, which saw the US suburban population jump from 20% in 1940 to 30% in 1960.

It’s self-funded

The FHA operates as a self-funded agency within the Department of Housing and Urban Development (HUD), generating revenue through mortgage insurance premiums paid by borrowers. Fun fact: while the FHA is a New Deal agency started by Roosevelt, HUD wasn’t created until 1965 by President Lyndon Johnson.

Its current commissioner was narrowly confirmed by the Senate

The FHA’s current commissioner is Julia Gordon, who recently served as president of the National Community Stabilization Trust, a nonprofit that supports affordable homeownership and neighborhood revitalization. Her appointment was narrowly confirmed in May 2022 by the US Senate, with some lawmakers voicing concerns about her views on the police. Vice President Kamala Harris cast the deciding vote, breaking a 50-50 tie.

It offers low down payment options

One of the FHA's key features is its low down payment requirement. Borrowers can qualify for an FHA loan with a down payment as low as 3.5%(!) of the purchase price. The minimum credit score required for a loan is 500.

It helped popularize the use of fully amortizing mortgages

Amortization is simply when borrowers make regular monthly payments that include both principal and interest, ensuring homeowners steadily build equity in their homes. The FHA helped popularize amortization, which departed from earlier models that would have interest-only payments or balloon payments.

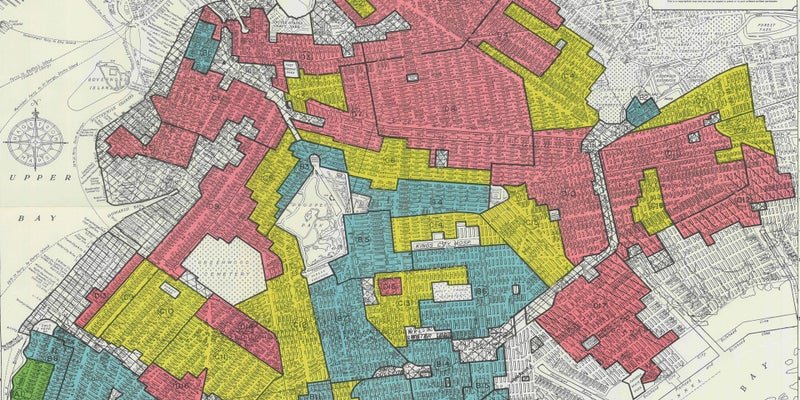

It has redressed some of its discriminatory history

Over time, the FHA has made efforts to redress its historical role in redlining and discriminatory lending practices. In 1968, President Johnson signed the Fair Housing Act (part of the The Civil Rights Act of 1968), which set out to eliminate housing discrimination and promote fair lending practices, including those related to FHA-backed loans.

It offers streamlined refinancing

The FHA offers a streamlined refinancing program designed to help existing FHA borrowers refinance their mortgages with minimal paperwork and reduced fees. The program is called the FHA Streamline Refinance. You can learn about the pros and cons of the program here.

It helped dampen the impact of the financial crisis

The FHA played a significant role during the 2008 financial crisis by insuring a substantial number of subprime and high-risk loans. The downside, however, was that it faced significant financial challenges and eventually needed federal assistance.

It offers reverse mortgages

A reverse mortgage is simply when a homeowner exchanges their ownership (equity) of a home for regular payments. The FHA administers the Home Equity Conversion Mortgage (HECM) program, which provides reverse mortgages for senior homeowners. This gives older adults the ability to convert home equity into cash.

If you’re in need of FHA support, our team of experts are here to help. Contact us today for a free consultation.